How to Get Better at Budgeting and Saving

Published Fri, May 1 2020 at 9:23 PM PT

-

By Obioha Okereke

Run into trouble with your budget? You are not alone. Just 13.1% of 2019 graduates said they felt completely prepared to handle their finances during college (College Finance).

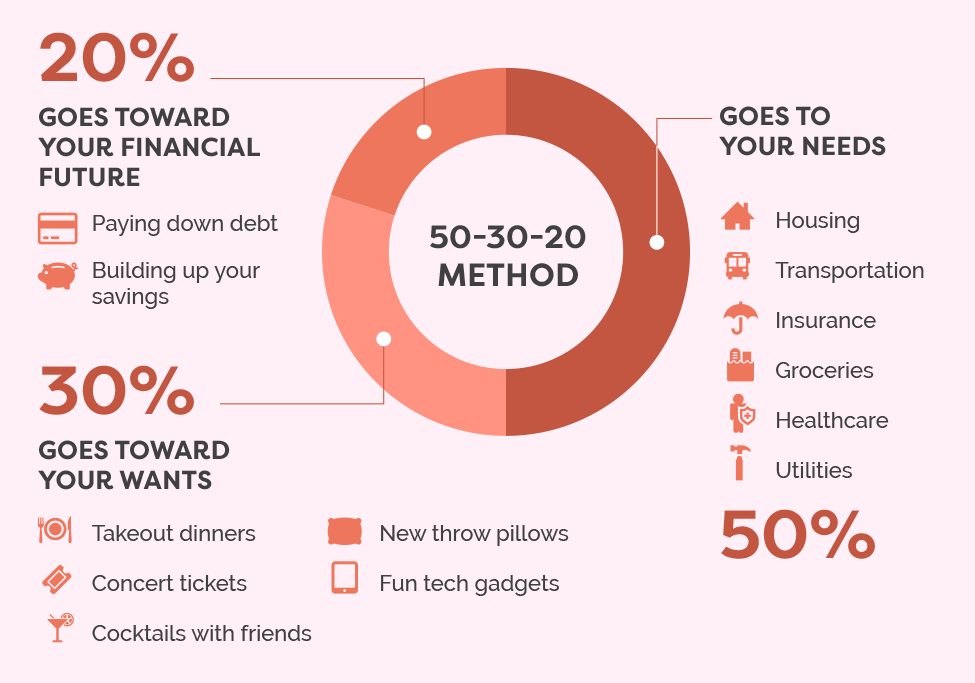

A common rule of thumb is the 50/30/20 rule which asserts that you spend 50% of your income on necessities, while 30% is to be allocated towards wants like dining out, and concerts. The last 20% is to be saved or invested. This budget is useful because it encourages people to break down their spending into three areas. It is a quick and easy solution if you don’t have time to categorize your expenses.

Source: Pinterest

Avoiding Common Mistakes

Budgeting is hard. It can be mentally and physically exhausting manually recording your expenses and income. Not to mention, it is not the most fun exercise. Fortunately, there’s an abundance of budgeting tools and apps available for you to use. With the Mint app, users are able to view their income and expenses anytime they want. The app takes your past transactions over a 90 day period and separates all your expenditures into different categories, while making a note of any income you received.

The app creates a budget for you and even goes as far to tell you what your gross income, net income, and total expenses are on a month to month basis. That being said, a budget only works if you monitor your spending and avoid these common mistakes:

NOT CREATING A BUDGET

Overspending on food

Abusing your credit card(s)

Failing to automate your savings

Stop overspending on food. Buy groceries and prepare meals at home. It is unbelievable how much money you can save by bringing lunch to work, or to school, so that you’re not tempted to dine out. This is not to say you should never go to your favorite restaurant, or grab a meal with friends - just be responsible about it.

Establish An Emergency Savings Account

An emergency savings account/fund is a separate bank account used to offset the cost of an unexpected event or emergency. This account should be 3-6 months of living expenses and is meant to be used only for emergencies. This can be a challenging amount to come up with for some, so researchers have suggested a different number. New research suggests that the number for emergency savings is $2,467.

“For people who struggle to set aside a portion of their income, $2,467 represents a good minimum savings rule that you should be working toward”

Once this amount has been saved, the likelihood of you experiencing financial hardship becomes low. After saving $2,467 or having three to six months of living expenses saved, the chances you fail to pay rent or are unable to pay your bills, becomes more unlikely.

Budgeting, saving, and investing, all come easier once you’ve established a safety cushion. You can start to build this up by automating your savings (having funds from your paychecks go directly to a savings account). If you struggle with saving, try putting $20 into an account, or a jar (could even be a shoe-box), every week. After a year, you’ll have over $1,000 saved, and after two and a half years of saving, you’ll have an emergency savings account.

You might already spend $20 a week eating fast food or on entertainment, so start saving where you can and you’d be surprised how much you can save. Budgeting can be overwhelming and tough to start - hopefully this gets you moving in the right direction.

Best of luck.

Already a master at budgeting or want to test your knowledge? Click on the button below.

![The Most Money I’ve Ever Spent - [Episode 1]](https://images.squarespace-cdn.com/content/v1/5e07c91e66be9216ac7e3646/1588411114892-TKDWZXNXY3BHJLFS1RHL/Chukwuma+Thumbnail+Screenshot.jpg)